Content

Achieving something on your list can be very fulfilling. The better your budgeting, the better you can plan for your savings goals and spending. It is easier to save money when you have an intended target to set money aside for that purpose. We all have something special we’d like to buy for our home or in life. That old couch that has seen better days in your living room begging for a replacement or a vacation you thought about for a long time but keep pushing off because it is too costly. Paying for these significant expenses can be challenging, but a sinking fund may pave a better way.

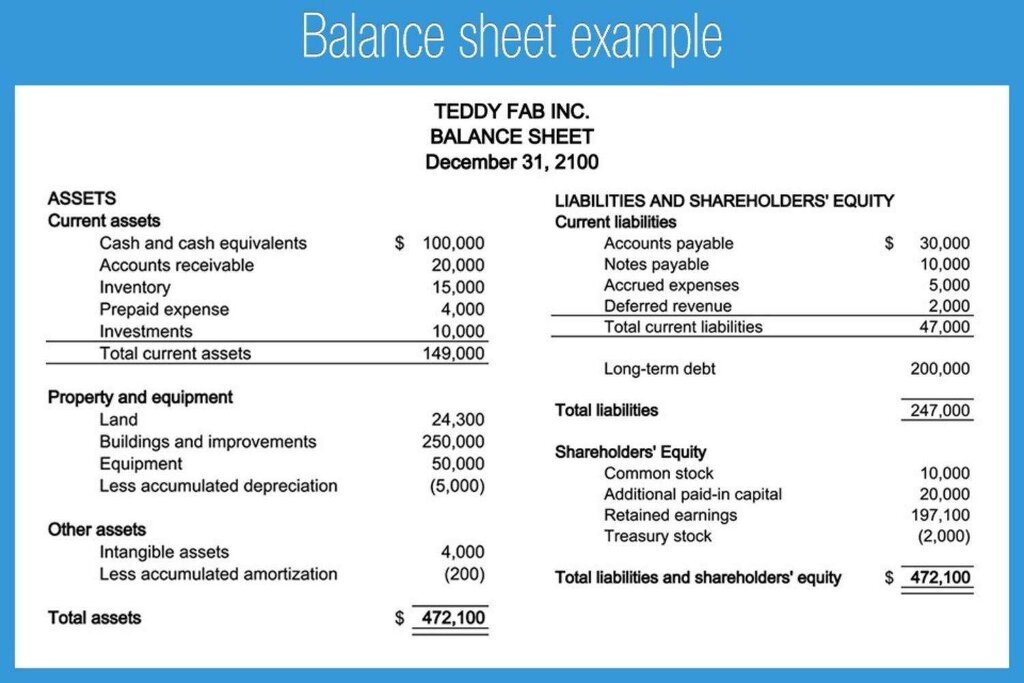

A ruling issued by the Financial Standards Accounting Board covering a particular topic. Usually, these statements are referenced with the acronym FAS followed by the numeral in a sinking fund cash or cash assets are set aside for the purpose of for a specific statement. For example, FAS 119 covers disclosures required for holdings of derivatives. See FAS for more information on specific accounting rulings.

Sinking Fund Method of Assets Depreciation – Finance Strategists

Banks are heavily dependent upon a few national and international data systems for transferring funds. A disruption in one of these systems can easily and quickly cascade into a major systemic problem. A payer or put swaption is the option to enter into a pay fixed/receive floating swap. A receiver or call swaption is the option to enter into receive fixed/pay floating swap.

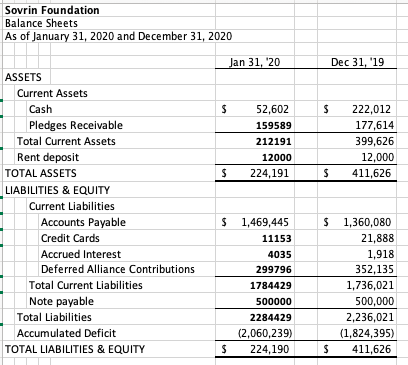

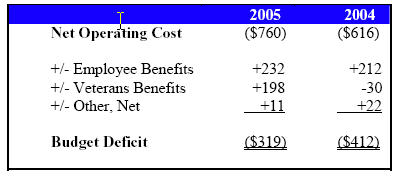

The advantage of having a sinking fund is that you will be able to pay off your loan faster. In return, it saves you money because if your rates have increased, you will not have as much total interest to pay on the principal. A savings account has the ability to earn interest on that money while it sits there until you are ready to use it for something else. For a sinking fund, you get the ability to pay back debt faster, but not necessarily incur less interest. It also provides financial security to the bond investors and thus, increases their trust in the company. A call provision is a provision on a bond or other fixed-income instrument that allows the issuer to repurchase and retire its bonds.

How Do You Calculate a Sinking Fund?

What an emergency fund does is simply help you cover unexpected expenses, such as car repairs or medical bills. You, then are able to pay off your debt faster, which reduces the total interest you pay on the loan. It can be used to redeem bonds and buy back shares by the company. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Compound frequency is the number of times interest is paid in a given period. DebtDebt is the practice of borrowing a tangible item, primarily money by an individual, business, or government, from another person, financial institution, or state.