Content

Cash Flows From Investing ActivityCash flow from investing activities refer to the money acquired or spent on the purchase or disposal of the fixed assets for the business purpose. For instance, the purchase of land and joint venture investment is cash outflow, while equipment sale is a cash inflow. Depreciation On AssetsDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

- Learn how to calculate fixed assets by jumping to the section below.

- Economists often refer to assets as being either capital goods or consumer goods — consumer goods are those sold to customers for their use; capital goods are used to produce the consumer product to be sold.

- Fixed assets in the form of machinery help in producing those goods.

- For real estate, external appraisers may value the assets occasionally.

- In order to facilitate the determination of the capitalization cost, any components necessary to place the property into service should be included on the same requisition.

An example of asset hierarchy in maintenance software would be the use of “parent-child”logic in managing records. This allows you to maintain your data in a way that considers the whole system instead of just individual parts. Tools such as Enterprise Asset Management and Computerized Maintenance Management System software help to make these jobs easier while performed more accurately.

Disadvantages of fixed assets

In other words, this ratio reflects cash flow quality and sustainability. Millersville University currently tracks its fixed assets using a software package developed by Systems and Computer Technology as a part of the Banner software product. The SCT Fixed Assets module provides a facility for tracking all fixed assets and it is integrated with the Purchasing and Payable modules. Fixed assets can be defined as tangible property that have significant value and can be used over an extended period of time.

Please note that some information might still be retained by your browser as it’s required for the site to function. Land improvements include expenditures that add functionality to a parcel of land, such as irrigation systems, fencing, and landscaping. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. ID Risk Analytics Analyze data to detect, prevent, and mitigate fraud. Practical Law Fast track case onboarding and practice with confidence. Tap into a team of experts who create and maintain timely, reliable, and accurate resources so you can jumpstart your work.

How do you calculate fixed assets?

Library books are recorded within the Net Investment in Plant account. Movable furniture, constructed by University personnel, should be capitalized and tagged. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. GoodwillGoodwill falls under the intangible asset category and is created to capture the excess of the purchase price above an acquired asset’s fair value.

- They are usually listed on a company’s balance sheet below the current assets.

- Fixed assets are physical (or “tangible”) assets that last at least a year or longer.

- The calculation is proven useful since knowing only the gross value of fixed assets doesn’t prove much utility for acquirers.

- Implementing a stellar asset life cycle management program requires alignment with your business strategy, data-driven decisions, and the right culture.

- 84% of retail investor accounts lose money when trading CFDs with this provider.

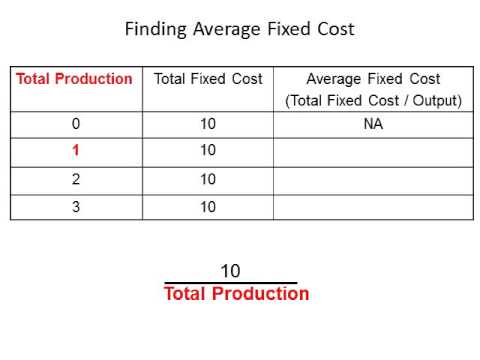

The calculation is proven useful since knowing only the gross value of fixed assets doesn’t prove much utility for acquirers. For example, a company may have spent a big amount of cash to purchase fixed assets in the past. But if they don’t maintain them well, the real value of those assets is far lower over time. Remember, when we discussed the P&L statement we discussed depreciation.

Intangible Assets

The net fixed assets is the net value of a company’s fixed assets. Let’s break it down to identify the meaning and value of the different variables in this problem. Recall that property, plant, and equipment (PP&E) is equal to the gross fixed assets. In terms of fixed assets, impairment commonly happens as a result of these assets being physically damaged. As a side note, the only fixed assets that doesn’t usually depreciate is land.

- Land is the only asset that is not depreciated, because it is considered to have an indeterminate useful life.

- These include white papers, government data, original reporting, and interviews with industry experts.

- While fixed assets appear as part of the balance sheet, the related depreciation expenses are shown on the company’s income statement.

- All amounts vouchered for capitalized property will be fed extracted, when running the asset extract process, and transferred to the Fixed Assets System with an origination tag.

- Debitoor’s larger plans make it easy to enter a fixed asset, set, and track depreciation for the useful life of the asset.

Assets can be thought of in terms of their convertibility to cash, whether they are tangible or intangible, and whether they are operating or nonoperating. Fixed assets are tangible, operating assets that are not easily convertible to cash. When determining the proper classification of an asset, there are several characteristics that set fixed assets apart from other asset types. Information about a corporation’s assets helps create accurate financial reporting, business valuations, and thorough financial analysis. Investors and creditors use these reports to determine a company’s financial health and decide whether to buy shares in or lend money to the business.

Similar to what we learnt in the previous chapter, non-current assets talk about the company’s assets, the economic benefit of which is enjoyed over a long period . Remember, an asset owned by a company is expected to give the company an economic benefit over its useful life. The fixed asset lifecycle goes from purchasing and placing the asset into service through disposing of the asset because it has reached the end of its usefulness to the entity. The time in between is the routine use and maintenance of the asset but can also include enhancements and improvements or repairs. Fixed assets can also be sold to other entities or transferred between locations or departments as their usage or business needs evolve.

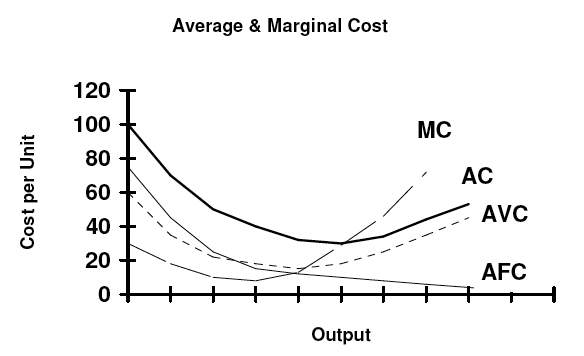

These systems help to pool all the valuable information you have per asset, to allow for more data-driven decisions. There are four main methods that are commonly used to calculate depreciation. Each of these methods takes slightly different assumptions on the rate and impact of devaluation. The goal of these methods is to approximate the worth of an asset over its entire useful lifespan. Asset depreciationrepresents the decrease in value of a piece of equipment over a period, usually calculated per year.

The Structured Query Language comprises several different data types that allow it to store different types of information… Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret what comes under fixed assets and act on emerging opportunities and trends. Raw materials are commodities companies use in the primary production or manufacturing of goods. Investopedia requires writers to use primary sources to support their work.

Fixed assets are usually one-time investments and have longer life spans. It is used to determine how successfully a company generates sales from its fixed assets. It is most useful among companies that require a large capital investment to conduct business, like manufacturers. This is to reflect the wear and tear from using the fixed asset in the company’s operations.